INSURANCE

Reliable Software’s insurance analytics solutions deliver a unique combination of advanced analytics techniques and domain experience

Insurance companies are facing increased competition, evolving customer preferences, and tighter margins. The insurance landscape today requires strategies that go beyond simply exposure and underwriting expertise. The ability to effectively use and monetize a variety of data sources utilizing advanced analytics is a tremendously powerful differentiator. Insurance-centric analytics that enables an improved customer experience increased marketing ROI and clarity of understanding of the market landscape is mission critical.

Reliable Software’s Insurance Analytics Solutions deliver a unique combination of advanced analytics techniques and domain experience to help businesses obtain a clear understanding of the market landscape, prioritize the most effective marketing channels and transform their digital data into actionable insights resulting in reduced customer churn, enhanced customer experiences and reduced fraud.

Customer Insights for Insurance Companies

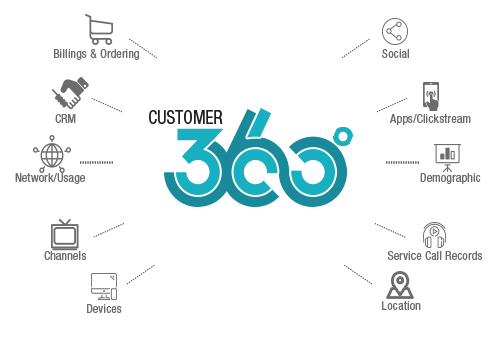

Achieving a 360° View of the Customer

Insurers can develop accurate insights of their policyholders based on behavioral data drawn from internal and external data sources. Reliable Software provides a customizable solution framework for insurance companies that enables advanced analytics delivered through our proprietary predictive and cognitive models, as well as pre-loaded customer segments and pre-configured dashboards. Our solution empowers decision makers to analyze their data quickly resulting in actionable insights delivered in real time.

Insurance Fraud Detection Solutions

More than 40% of fraud investigations are initiated because of a tip. However, tips and intuition are not sufficient remedies as the volume and complexity of fraud continues to grow. Many insurers lack the right tools to sift through and analyze the tremendous volume and variety of data available today.

Integrating data from disparate internal and external sources is critical for making the connections necessary to enable you to help detect and prevent fraud.